Millions of additional eligible Americans are now determining which coverage options will be best for them in 2023 as the Medicare Annual Enrollment Period (AEP) has begun.

Don’t miss this chance to switch your coverage if you’re one of those who are now registered with Medicare. A complete breakdown of the Medicare program along with the most significant changes in 2023 is included here.

What is Medicare Annual Enrollment Period (AEP)?

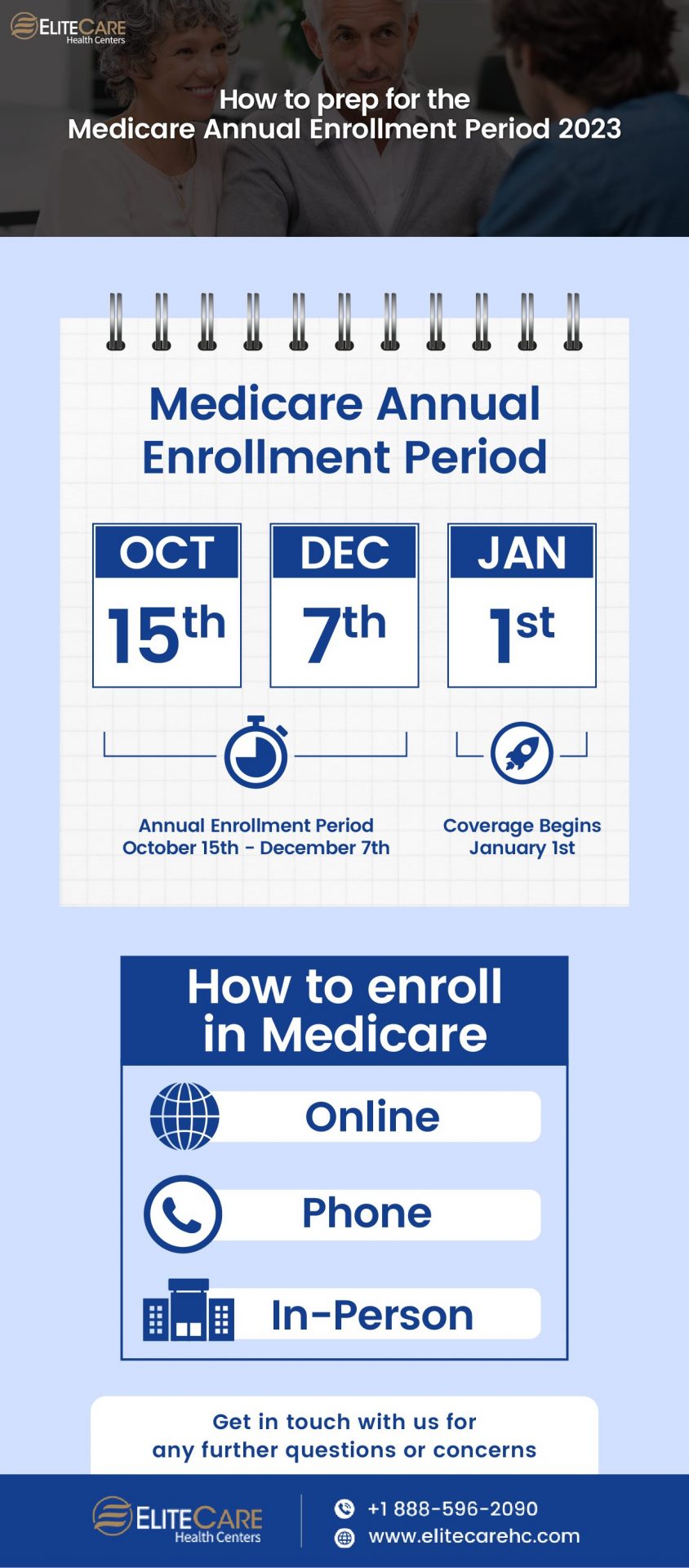

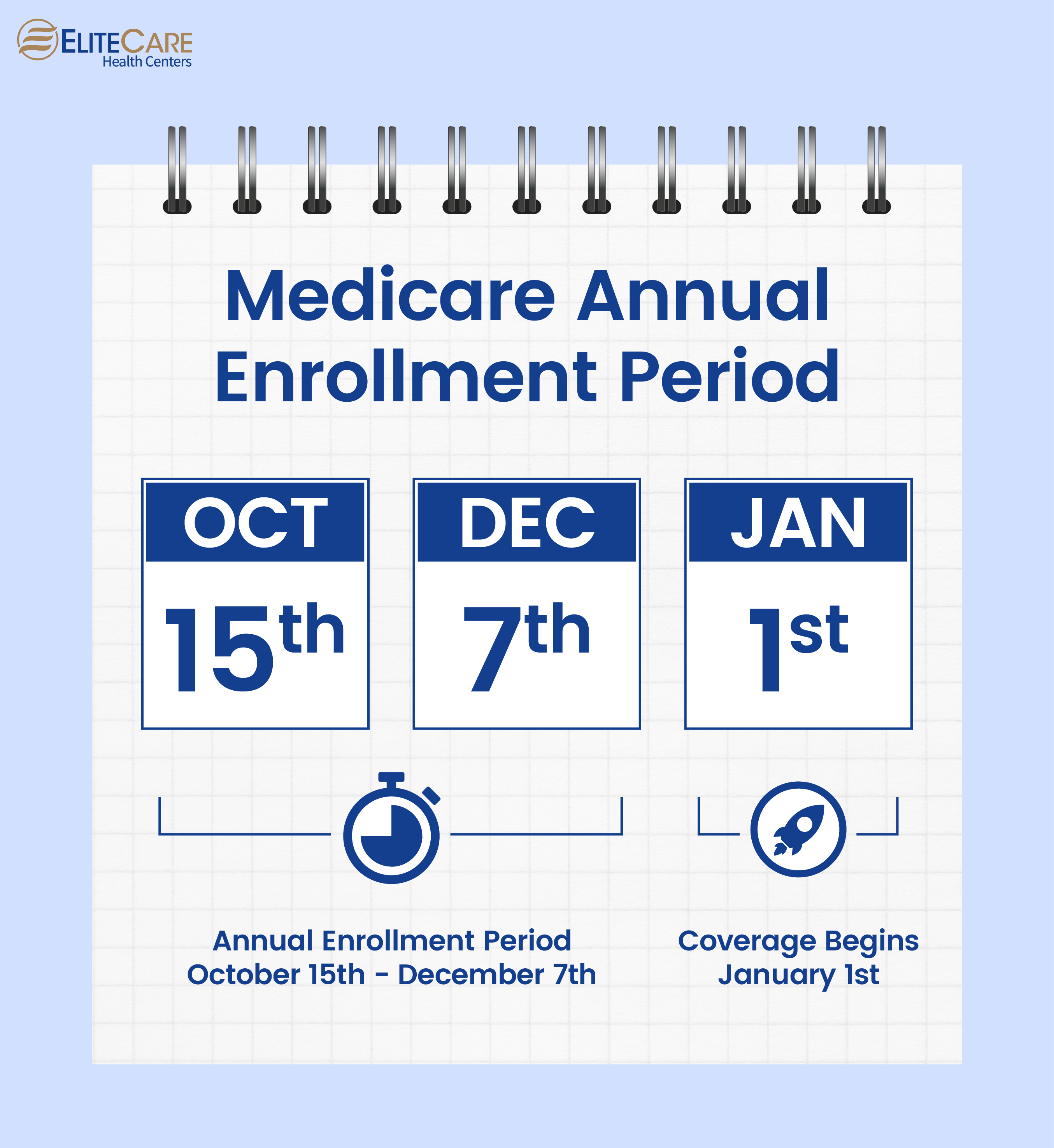

The annual Medicare enrollment period takes place between October 15 and December 7 of each year. The time has come for eligible beneficiaries to modify their prescription medication and health plan under Medicare. As of January 1st, 2023, these adjustments will be implemented.

Medicare enrollees don’t need to take any action during the AEP period if they are satisfied with their current coverage. Instead, protection will automatically extend into the following year.

However, it is still wise to investigate alternatives that are currently available. It is common for health insurance providers to increase the available Medicare Advantage plans each year, so you will likely find a better plan this year.

Medicare changes for 2023

Medicare Part A changes

Inpatient hospital deductible for Medicare Part A that enrollees must pay if they are admitted to the hospital will rise by $44 to $1,600 in 2023 from $1,556 in 2022. The beneficiaries’ share of expenses for the first 60 days of Medicare-supported inpatient hospital care during a benefit period is covered by the Part A inpatient hospital deductible.

Medicare Part B changes

The Social Security Act establishes the Medicare Part B premium, deductible, and coinsurance amounts each year. Medicare Part B members’ monthly premium will be $164.90 in 2023, down from $170.10 in 2022 by $5.20. All Medicare Part B beneficiaries will have an annual deductible of $226 in 2023, down from an annual deductible of $233 in 2022.

These are two major changes for Medicare 2023. For detailed insights on the new guidelines of Medicare, please visit this factsheet by the Centers for Medicare & Medicaid Services.

How to enroll in Medicare

It’s important to know that signing up for Medicare Parts A and B differs from signing up for Medicare Advantage (Part C), Part D, or Medicare supplement insurance.

For Medicare Part A & B

Some individual’s enrollment in Medicare Parts A and B are automatic, whereas some must enroll voluntarily.

Medicare Parts A and B will be enrolled in your account automatically if:

You have enrolled in Medicare Parts A and B automatically if you receive Railroad Retirement benefits or Social Security retirement benefits.

Medicare Parts A and B must be enrolled by yourself if:

You must voluntarily enroll in Medicare if you are not receiving Railroad Retirement payments or Social Security retirement benefits.

How can you sign yourself up for Medicare

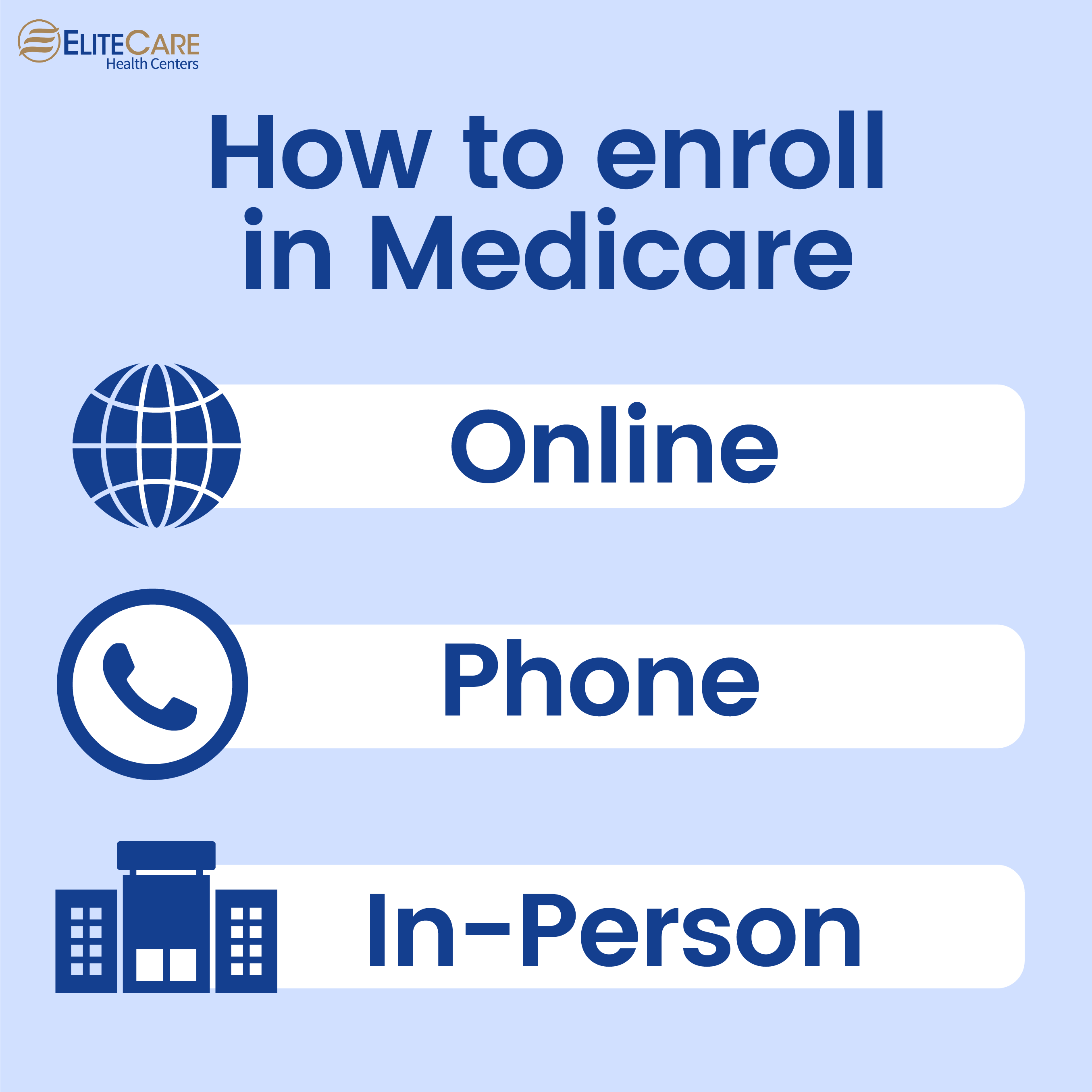

Medicare Part A and Part B enrollment can be undertaken in one of these three ways:

- Go to www.SocialSecurity.gov online and follow the instructions.

- Call Social Security at 1-800-772-1213 (TTY users should dial 1-800-325-0778) from 7 a.m. to 7 p.m., Monday through Friday. to 7p.m.

- Visit the Social Security office in your area.

After enrolling, wait around three weeks for your Medicare card to arrive in the mail.

For Medicare Part C (Medicare Advantage) or Part D (Prescription Drug)

Only private insurance providers provide Medicare Advantage (Part C) and Part D prescription medication coverage. Both require direct enrollment with the plan provider, which you may either do online, over the phone, or with an agent.

Steps for signing up for Part C

- First sign up for Medicare Parts A and B.

- Find insurance companies that provide Medicare Advantage plans in your area.

- You can find out more about the plans that are available in your area by researching them online or approaching the insurance provider directly.

- Choose a plan that offers the medical coverage you require, then enroll with the plan’s provider—by phone, online, or through an agent.

Steps for signing up for Part D

- Initially enroll in Part A or Part B. (You don’t need both to receive Part D.)

- Research insurance companies that provide Part D coverage in your area.

- By reviewing them online or approaching the provider directly, you may find out more about the plans that are offered in your area and make a comparison.

- Choose a plan that offers the medical coverage you require, then enroll with the plan’s provider—by phone, online, or through an agent.

How to keep track of everything related to Medicare?

If you don’t already have one, register for a myMedicare.gov account. MyMedicare is a safe and cost-free online service for managing your personal information linked to Original Medicare benefits and services. Original Medicare beneficiaries can check their coverage, enrollment status, and claims information through their MyMedicare accounts.

Read More: Decoding Medicare and Medicaid

By looking back at a list of all the medications you’ve filled in throughout the course of the year in your account, you may quickly select the drug plan that best fits your prescription list. You will find it simpler to search for hospitals and providers who are covered by your plan using this procedure. For instance, if you’re trying to find a Florida medical facility that accepts your insurance, this website can help you rapidly find reliable results.

We advise contacting a Medicare expert if you have any additional questions or concerns about Medicare or would like more in-depth information about it.

- Tags:best primary doctors near meCenter For Wellnesscommon health problems in elderlyhealth and wellness centerhealth and wellness servicesmedical clinicMedicare advantagesmedicare benefitspreventive wellnessprimary care physicianprimary care physicians of floridasenior care serviceswellness care centerswellness check doctor